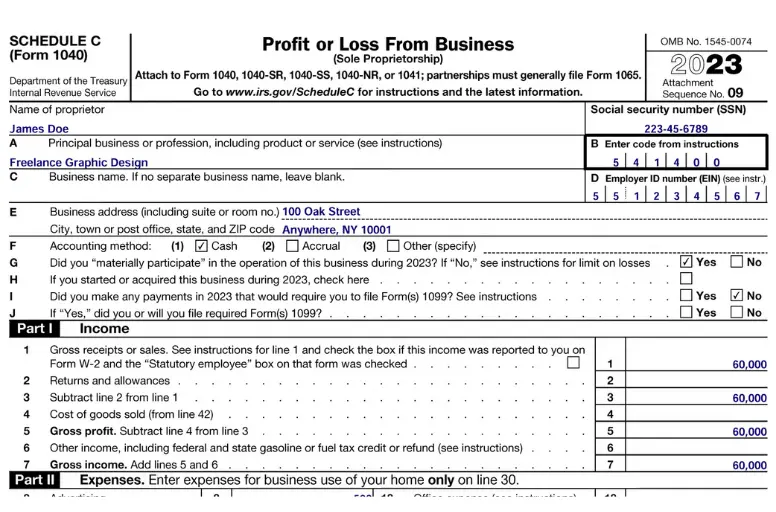

Amazon Haul 2025 Tax Return Form. To download your amazon flex tax form, click on the link in your account. Schedule c is the tax form used by amazon flex drivers to report the income and expenses related to their business.

Free shipping & cash on delivery available. Explore the top tax deductions available for amazon flex drivers.

Do You Pay Taxes on Amazon FBA? Tax Information for 2025, The amazon flex mileage deduction can reduce your taxable income.

How to Submit Amazon Tax Identity Information Amazon Tax Information, Go to tax return for individuals (nat 2541) on our publications ordering service (pos) at iorder.com.au to get a.

How To Fill Up Amazon Tax Information Form as a NonUSA Person? A, Schedule c is used to report your business.

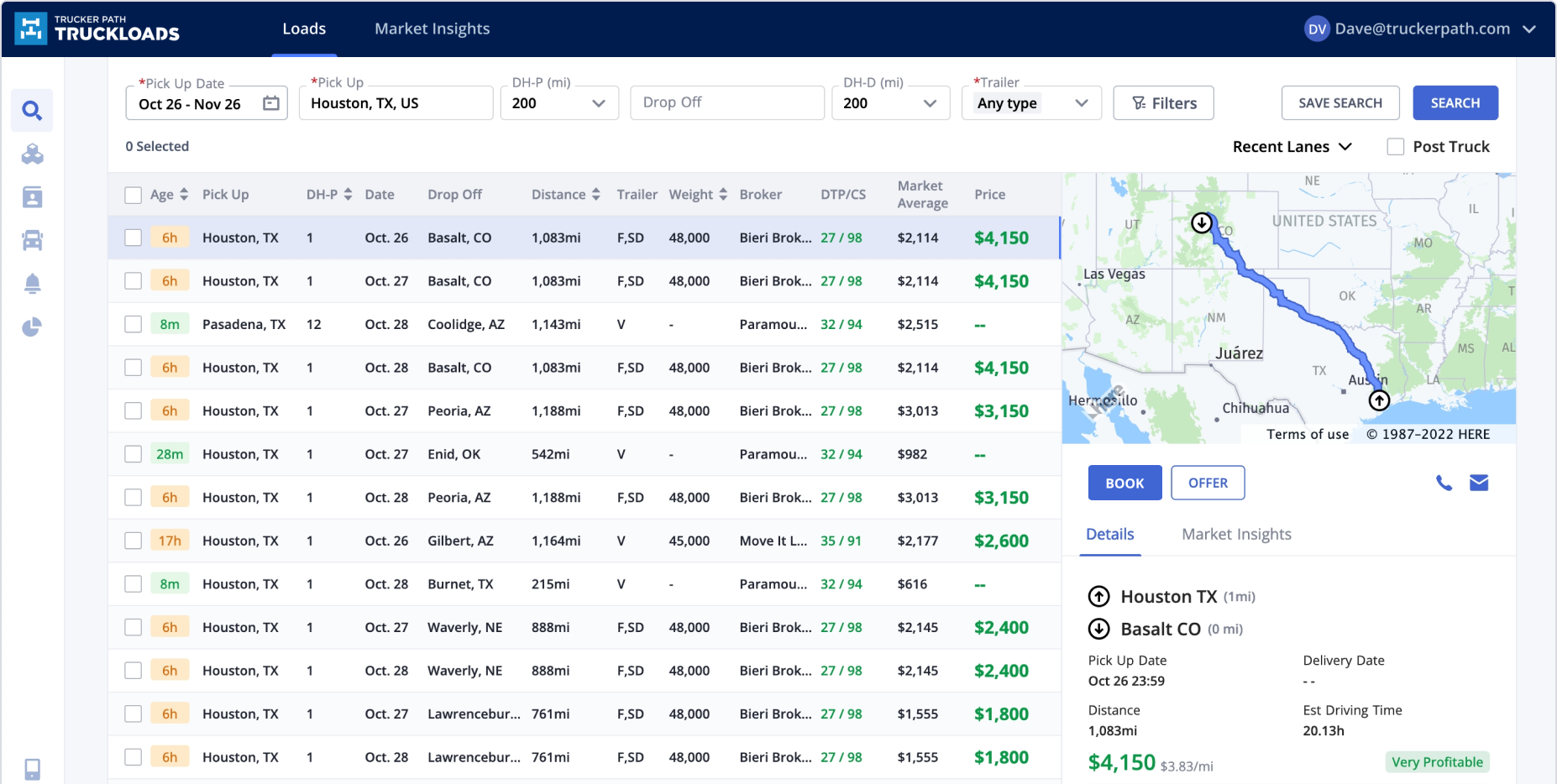

Amazon Hauling Commercial Loads 2025 Schedule Gabbie Darlleen, Get what you need to know about tax deductions for amazon flex drivers in this helpful guide.

How To Fill Amazon KDP Tax Information in Nigeria Stepbystep, Amazon haul gladly accepts returns of eligible items over $3.00 within 15 days of delivery, at no cost to you.

How to View all the Amazon Tax Forms (at One Place) YouTube, And international, federal, state, or local.

Amazon Seller Taxes The Compulsory Fees Sellers Must Look At, Reddit's home for tax geeks and taxpayers!

Hauling For Amazon Trucking 2025 Season Gustie Elsinore, Form 16a is the certificate of deduction of tds issued by amazon on a quarterly basis in accordance with income tax act.

Sales Tax Requirements for New Amazon FBA Sellers FreeCashFlow.io 2025, Items must be returned according to instructions provided by.

Amazon Hauling Commercial Loads 2025 Schedule Gabbie Darlleen, Amazon haul gladly accepts returns of eligible items over $3.00 within 15 days of delivery, at no cost to you.